Virtual Reality: Market Adoption

After taking quite a dive into VR, my general understanding is that adoption is predicated on content. Content, is dependent on -- though not limited to -- the (1) price and ease of production (2) the distribution of content, (3) price of hardware, (4) competitors, (5) overall experience and engagement.

So, the content:

While we are starting to see variability in the technology (headsets, production and distribution), content seems to be bifurcated into small scale entry points (for instance the WSJ’s Nasdaq roller coaster and NYT’s VR content) and big budget immersives (like The Martian and Samsung’s roller coaster experiences and EVE: Valkyrie and Lucky’s Tale games).

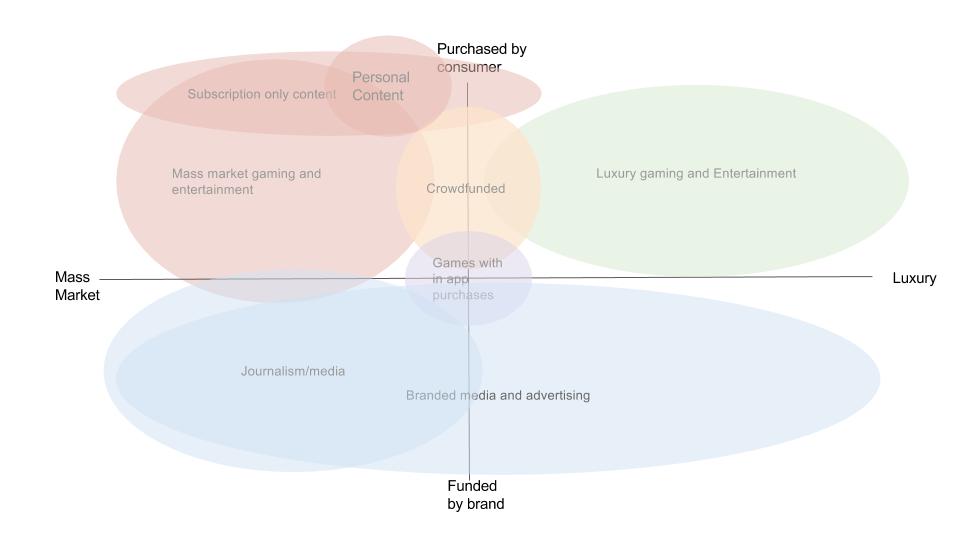

Another interesting way to parse the content is by who is likely to fund it -- consumers or advertisers. Entertainment and gaming industries are offering the most interesting experiences, certainly, but they are also the most incentivised to do so as they hope to monetize VR experiences as a separate product. Our peers, on the other hand, seem to be looking to VR as an ads (the NYT is already margin positive (Seeking Alpha) on their VR) and/or reach initiative. Other business models could one day include subscriptions, in-experience purchases, and more

Given these two ways of looking at it, we have a content map that looks like:

And with a few examples:

Despite the limitations of being in the very nascent stages of VR, there are a number of publishers that have created VR or 360 video content in order to both “make the market” and experiment with this form of storytelling. Gannet recently announced they will be creating serialised content and a daily VR show in 2016. Other companies who have produced either 360 or VR experiences include: BBC, Discovery, Fusion, Gannet, WSJ, NYT, Washington Post, Frontline, Vice and more.