Facebook wants Live Video to be the future, paying close to $50mn to celebrities and publishers to create live video and prioritizing it in their newsfeed algorithm. While Facebook may be making the most headlines right now, it’s not the only company putting the spotlight on live video. In the last year Meerkat (now pivoted), Periscope (now owned by Twitter), YouNow and most recently YouTube and tumblr launched live streaming.

So, why is Facebook prioritizing streaming video? Because it “is looking to compete for television advertising... [and] is anxious about the future. People are sharing less about themselves, which slows Facebook’s growth and cuts at the heart of its most profitable product, the News Feed…[this] is one attempt to solve that problem.”

Live streaming may very well be a Facebook driven play for revenue and relevance, and not necessarily a question of demand. For instance, this recent Reuters study reports that over 3/4ths of people rely on text for their news, finding it faster and more convenient than video. What’s more, these findings apply to video at large -- not just live video; a majority of people prefer text to any type of video when getting their news.

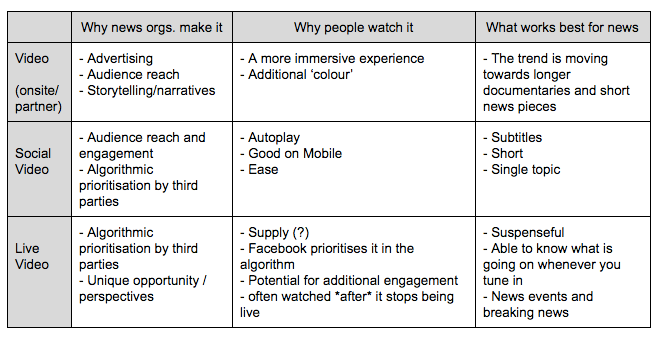

Here, we look at different video formats: